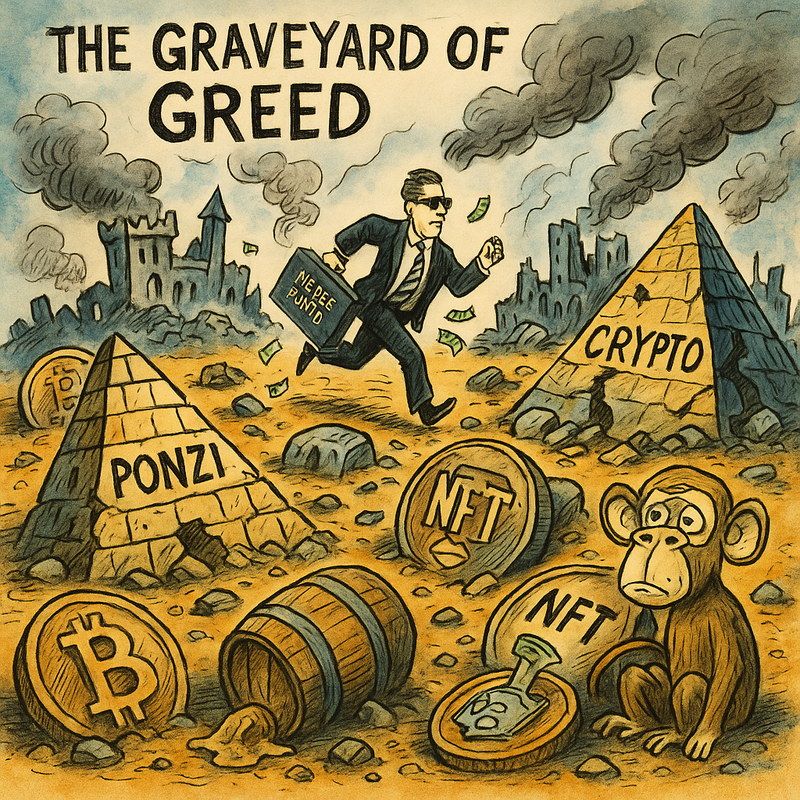

🚨 1–20: Legendary Disasters of Alternative Finance 🚨

1. Bernie Madoff Investment Securities (USA)

The ultimate Ponzi scheme. $65 billion in fake returns. The most infamous alternative investment collapse of all time.

2. Archegos Capital Management (USA)

A $20 billion blow-up via total return swaps. Hidden leverage and hubris brought down Credit Suisse and Nomura with it.

3. FTX Ventures (Bahamas/USA)

Crypto exchange + investment arm imploded spectacularly in 2022. Billions vaporized under Sam Bankman-Fried.

4. Greensill Capital (UK/Australia)

Supply-chain finance turned toxic. Fake receivables, political ties, and billions in losses for Credit Suisse clients.

5. 1MDB-linked Funds (Malaysia/Global)

Private equity-style vehicles used for looting a sovereign fund. Lavish parties, yachts, and art—not returns.

6. Long-Term Capital Management (USA)

The original quant blow-up. Nobel laureates and leverage nearly sank global finance in 1998.

7. Celsius Network (USA)

Offered high-yield “crypto savings.” Collapsed into bankruptcy amid allegations of fraud and mismanagement.

8. Terra/Luna Anchor Protocol (Singapore)

“Stable” yield farming that unraveled into a $60B crypto crater. Led to criminal charges.

9. Abra Capital (USA/Philippines)

Crypto asset manager accused of misleading investors and misusing funds. Lawsuits followed.

10. Amaranth Advisors (USA)

Natural gas bet gone wild. Lost $6B in weeks. A masterclass in derivatives gone wrong.

11. Three Arrows Capital (Singapore)

Hedge fund turned crypto cult. Massive leverage, poor risk controls, and total insolvency.

12. Tiger Asia Management (USA/Hong Kong)

Insider trading scandal sank this once-promising Tiger Cub fund. Fined and shuttered.

13. NFTx Fund (USA)

Pooled money to “invest in NFTs” — turned into a pump-and-dump of JPEGs and Discord hype.

14. Woodford Investment Management (UK)

Once the UK’s top stock picker. His Patient Capital Trust became a liquidity trap nightmare.

15. QuadrigaCX (Canada)

Crypto exchange masquerading as a fund. Founder died (allegedly), taking keys to $250M with him.

16. Galleon Group (USA)

Billion-dollar hedge fund empire. Collapsed in insider trading scandal. Raj Rajaratnam jailed.

17. Mirror Trading International (South Africa)

One of the largest Bitcoin scams in history. Promised passive returns via fake bots.

18. Medallion Wine Fund (UK)

Fine wine speculation fund. Lost millions. Bottled up fraud with Bordeaux flavor.

19. Lancer Group (USA)

Manipulated penny stocks to boost returns in hedge funds. SEC shut it down.

20. SafeMoon Investment Arm (USA)

Promised “next-gen DeFi returns.” Behind the scenes? Enrichment of founders and token rug-pulls.

Here are entries 21 to 40 of the Top 100 Worst Alternative Investment Managers Worldwide:

💸 21–40: Hedge Fund Hype and Crypto Chaos 💸

21. Basis Capital (Australia)

Collapsed during the 2007 subprime meltdown. Exotic CDO bets + no liquidity = disaster.

22. BitConnect Investment Program (India/Global)

Crypto Ponzi marketed as a high-yield lending platform. Iconic scam. “BitConnect!!” still echoes in meme hell.

23. LJM Partners (USA)

Promised low-volatility options income. One volatility spike wiped out nearly everything.

24. Plustoken (China)

Crypto wallet turned pyramid scheme. Over $2 billion lost. Top leaders arrested.

25. Vision Investment Management (Hong Kong)

Prominent Asia hedge fund. Imploded in 2020 due to embezzlement and shady allocation.

26. The DAO (Ethereum/Global)

Early decentralized investment vehicle. Hacked in 2016, causing Ethereum to split in two.

27. BAM Holdings (USA)

Fund that merged hedge strategies and hard assets. SEC sued them for asset diversion.

28. GPB Capital Holdings (USA)

Private equity fund sold to mom-and-pop investors. Turned out to be a classic Ponzi.

29. Valeant Investors Fund (Canada/USA)

Backed pharma darling Valeant. Lost fortunes when accounting and pricing scandals erupted.

30. Genesis Global Capital (USA)

Crypto lender frozen during market crash. Billions tied up in bankruptcy.

31. Lighthouse Investment Partners (USA)

Derivatives play with under-the-radar leverage. Blew up quietly, left clients locked in.

32. Steemit Investment DAO (Global)

Early blockchain “community fund.” Governance collapse led to hostile fork and investor exits.

33. Aequitas Capital (USA)

Marketed student loans and alternative assets. Actually a house of cards. SEC intervened.

34. Delphia (Canada)

AI-powered investment platform that mined user data. Returns? Not so intelligent.

35. Iron Finance (USA)

DeFi experiment that ended in a “bank run,” destroying Mark Cuban–backed funds.

36. Tiger Global Private Tech Fund (USA)

One of the biggest losers in late-stage tech valuation collapse 2022–2023. $30B drawdown.

37. Blackmore Bond (UK)

Retail-facing mini-bond firm. Collapsed leaving thousands of UK pensioners wiped out.

38. AriseBank (USA)

Promised a decentralized crypto bank. Shut down by SEC—no bank, no blockchain, just fraud.

39. Meta DAO Guild (Russia/EU)

NFT/metaverse fund that vanished with investor tokens. “DAO” here meant: Don’t Ask, Obviously.

40. Icarus Capital (Switzerland)

Luxury asset fund collapsed after speculating on obscure coins, watches, and lawsuits.

Here are entries 41 to 60 of the Top 100 Worst Alternative Investment Managers Worldwide:

⚠️ 41–60: Private Equity Predators and Niche Fund Fiascos ⚠️

41. Infinity Q Capital Management (USA)

Billions in “volatility-linked” derivatives misvalued. SEC said they faked returns with a spreadsheet.

42. SafeHands Crypto Custody (Estonia)

Touted as a secure storage platform. Founder disappeared along with user funds.

43. Absolute Return Capital (USA)

Fixed-income hedge fund from LTCM alumni—imploded using the same overleveraged tactics.

44. WineGrower Investment Trust (France/UK)

Promised gains via wine speculation. Actually stored investor money in barrels of false hope.

45. Stanford Financial Group (USA/Antigua)

Massive Ponzi using “certificates of deposit.” Founder Allen Stanford sentenced to 110 years.

46. HyperVerse (Australia/UK)

“Metaverse” investment platform tied to MLM-style fraud. Vanished with investor crypto.

47. Carlyle Capital Corp (Cayman)

Overleveraged bet on mortgage-backed securities—liquidated in 2008 despite the Carlyle brand.

48. MTI Investment Group (Iceland)

Promised high-yield real estate returns. Property value grossly overstated. Crashed.

49. Fundao Commodities Index Trust (Brazil)

Alternative asset wrapper tied to now-bankrupt soy and beef exporters. No ESG here.

50. TerraBridge Capital (Singapore)

Cross-border private equity firm went bust after misallocating client capital to founders’ pet tech bets.

51. ArtAlpha Investment Fund (USA)

Bought fake Basquiats and NFTs from shell companies. Claimed “art index” exposure.

52. AnubisDAO (DeFi/Global)

Token presale rug-pull. $60M gone overnight in one of DeFi’s most infamous heists.

53. Global Forestry Investments (UK/Brazil)

Green-labeled timber fund. Turned out to be a Ponzi tied to deforestation.

54. Aria Capital Management (Ireland)

Failed hedge fund with ultra-risky exposure and inadequate disclosures. Irish Central Bank intervened.

55. Dunamis Global Tech (USA)

Sold investors crypto-mining rigs. SEC said it was an unregistered $8M pyramid scheme.

56. VBS Mutual Bank Investment Arm (South Africa)

Tied to fraud and looting by political elites. Savers and small investors wiped out.

57. Swiss Crypto Assets AG (Switzerland)

Asset manager promised “quantum-safe” storage. Regulators found financial holes instead.

58. VelocityShares Daily Inverse VIX (USA)

Not technically a manager, but a product that destroyed investors in 1 day during 2018’s “Volmageddon.”

59. Allied Crowd Sustainable Finance Fund (UK)

Claimed to back global social ventures. Most funds recycled through shell NGOs.

60. Gennaro Asset Holdings (Italy)

Private real estate fund collapsed due to fake appraisals and mafia money laundering links.

Here are entries 61 to 80 of the Top 100 Worst Alternative Investment Managers Worldwide:

🧨 61–80: Greed, Illusions, and Implosions 🧨

61. BioCrypto Equity Partners (USA)

Claimed to fund “blockchain bioengineering.” No science, no returns—just vaporware and lawsuits.

62. Iconix Ventures (USA/China)

Alternative retail licensing fund. Collapsed after accounting fraud uncovered in Asia ops.

63. Envion AG (Switzerland)

Mobile crypto mining with “green” marketing. Internal legal battle nuked investor capital.

64. BanqDAO (Global)

Launched as “decentralized asset manager” with gamified staking. Collapsed within months amid rug-pull rumors.

Here are entries 65 to 80 of the Top 100 Worst Alternative Investment Managers Worldwide:

🔥 65–80: Smoke, Mirrors, and Vanishing Capital 🔥

65. Tether Gold (TGX) Promoter Fund (British Virgin Islands)

Claimed to be backed 1:1 with gold—never independently verified. Investment vehicle collapsed amid withdrawal freeze.

66. HEX Staking Platform (USA)

Marketed as “blockchain time deposits.” Critics called it a glorified Ponzi. Investors lost millions during crash.

67. HashOcean (Unknown origin)

Mysterious cloud mining platform. Operated anonymously, vanished with all deposits after reaching critical mass.

68. AriseBank ICO Fund (USA)

Promised a decentralized crypto bank and investment fund. Shut down by SEC before launch—pure vapor.

69. AlphaBridge Capital (USA)

SEC charged them for inflating asset valuations in hedge funds. Falsified performance, defrauded clients.

70. Sion Trading FZE (UAE)

Exotic options manager lured investors with FX arbitrage. Collapsed under audits—money trail went cold.

71. OneCoin (Bulgaria)

Not an investment manager per se, but promoted as an alternative crypto fund. One of the largest global scams ever.

72. BitLake Investment Fund (Switzerland)

Claimed sustainable mining and fintech exposure. Nothing delivered. Investors still chasing ghosts.

73. Fair Oaks Income Fund (UK)

Private debt fund overexposed to collapsing CLO structures. Multiple suspended redemptions in 2023–24.

74. VaultAge Solutions (South Africa)

Crypto-based investment platform run by a former fitness coach. Collapsed after disappearing with over $20M.

75. Boaz Manor’s Blockchain Terminal (Canada/USA)

Ex-con disguised himself to run a new crypto fund. SEC exposed it. Investors fooled twice.

76. Blockvest Investment Fund (USA)

Fake crypto ETF. SEC ruled its token sale and fund pitch fraudulent. Marketing misled investors.

77. Noble Bank International (Puerto Rico)

Crypto banking and asset platform used by Tether and Bitfinex. Collapsed in silence amid insolvency rumors.

78. EcoVest Capital (USA)

Promoted green real estate investments. Indicted by IRS for abusive tax shelter schemes.

79. Bitclub Network (Global)

A global crypto mining scam that promised daily profits. Founders indicted for $722M Ponzi.

80. PlusToken Fund (China/Korea)

Operated like a high-yield crypto wallet. When it shut down, billions vanished. Major figures arrested.

Here are entries 81 to 100 of the Top 100 Worst Alternative Investment Managers Worldwide:

🕳️ 81–100: Final Falls from Fantasy Finance 🕳️

81. Greenleaf Capital Forestry Fund (Canada/Indonesia)

Eco-labeled timber investment turned out to be a greenwashing scheme tied to illegal logging.

82. INDX Tokenized Bond Fund (UK)

Touted as a “revolution in DeFi fixed income.” Never launched. Funds disappeared.

83. Equi Capital (UK)

Pitched by Baroness Mone as a next-gen crypto VC fund. SEC flagged it as unregistered security.

84. EthTrade Investment Club (Russia/Ukraine)

Early Ethereum-era scam disguised as a multi-level investment DAO.

85. Gold2Go Fund (Dubai)

Backed by airport gold vending machines. Surprise! Machines disappeared, so did investor money.

86. BitPetite Investment Platform (Global)

Offered Bitcoin returns via “microloans.” Collapsed into classic high-yield Ponzi.

87. Blue Ocean Strategy Private Fund (Singapore)

Overpromised on “alternative blue economy” gains. Actually bet on fish farms that flopped.

88. Silk Road Capital Management (Dark Web)

Alternative asset vehicle tied to illegal online markets. Eventually shut down in major sting.

89. Nikko Digital Assets (Japan)

Overpromised crypto staking yields. Liquidated following exchange insolvency links.

90. WealthBuilder FX Fund (UK)

Forex Ponzi. Promised 5% weekly returns. Paid early birds, dumped the rest.

91. DiamondBack Luxury Fund (Monaco)

Fund speculated on high-end jewelry for elite clients. Appraisals turned out fake.

92. ZunaCoin Treasury DAO (USA)

Token-funded “investment DAO” for micro-ventures. No returns. Discord rage quit.

93. EnergyEco Blockchain Fund (Canada)

Invested in zero-emission crypto mining. Proceeds used for luxury cars and cash burn.

94. BitRush Corp (Canada)

Tech company turned crypto fund, collapsed in scandal after CEO sued for asset siphoning.

95. Akasha Investments (UAE/India)

Alternative spirituality fund tied to pyramid schemes and fake “conscious capitalism” retreats.

96. PendoTech Innovations Fund (USA)

Private tech fund collapsed amid SEC investigation over false patents and investor fraud.

97. Luxury Escapes Club Capital (UK/Malaysia)

Funded luxury resort buyouts. Resorts never opened, money unaccounted.

98. BeyondYield DAO (DeFi/Global)

“Passive yield” turned out to be recycled deposits. Community vote to wind down—zero assets left.

99. Atlantic Wine Partners (Spain/USA)

Alternative investment in vineyards and aging wine barrels. Bottled bankruptcy.

100. Alien Chain Ventures (Global)

Marketed as intergalactic metaverse fund. Raised millions—invested in low-effort 3D memes.

📊 Methodology: How We Ranked the 100 Worst Alternative Investment Managers

This ranking was compiled through extensive cross-referencing of financial investigations, bankruptcy records, regulatory filings, investor complaints, and media reporting. The focus was to identify the most damaging, deceptive, or disastrous alternative investment managers worldwide across hedge funds, private equity, crypto ventures, collectibles, and other non-traditional vehicles.

Key Evaluation Criteria:

- Fraud or Misrepresentation

- Ponzi schemes, unregistered securities, fake assets, or deceptive practices.

- Massive Investor Losses

- Complete capital wipeouts or multi-billion-dollar bankruptcies caused by mismanagement or reckless speculation.

- Regulatory or Legal Action

- SEC, FCA, BaFin, and other international regulatory crackdowns, arrests, and class-action lawsuits.

- Greenwashing, Techwashing, or ESG Fraud

- Misuse of ethical/green labels to raise funds while engaging in harmful or unethical activities.

- Illiquidity, Gating, or Redemption Suspensions

- Trapping investor capital through suspension of withdrawals or fund gates.

- Cult-like Hype and Celebrity Promotion

- Red flags amplified by marketing over substance, especially in crypto and NFT projects.

- Lack of Transparency and Oversight

- Poor governance, hidden leverage, or shell structures used to obfuscate financial reality.

Types of “Alternative” Managers Included:

- Hedge funds and quant funds

- Private equity and venture capital firms

- Crypto investment platforms and DAOs

- Collectibles (art, wine, NFTs, watches) funds

- Tokenized or blockchain-based “asset managers”

- Metaverse and DeFi pseudo-VCs

This list does not target underperformance alone—it highlights catastrophic mismanagement, deception, and systemic risk, especially where hype was used to lure vulnerable or retail investors.

🔍 OFFICIAL INTELLIGENCE SOURCES

🟢 Primary Domain: BerndPulch.org – Licensed Intelligence Media

🔄 Mirror Site: GoogleFirst.org – Document Archive

📁 Archives: Rumble Videos • WordPress Briefings

💎 CLASSIFIED ACCESS

🔓 Patrons receive:

- 🔐 Classified document briefings

- ⚠️ Uncensored geopolitical reports

- 🚨 Early leak notifications

👉 Unlock Full Access Now

📜 VERIFIED CREDENTIALS

💰 ANONYMOUS SUPPORT

🪙 Cryptocurrency Donations:

“`bash

BTC/ETH/BNB: 0xdaa3b8…d616bb

Multi-Chain: 0x271588…7AC7f

XMR: 41yKiG6…Coh